maine tax rates compared to other states

If you make 70000 a year living in the region of Maine USA you will be taxed 12188. Owns a home valued at 217500 median US.

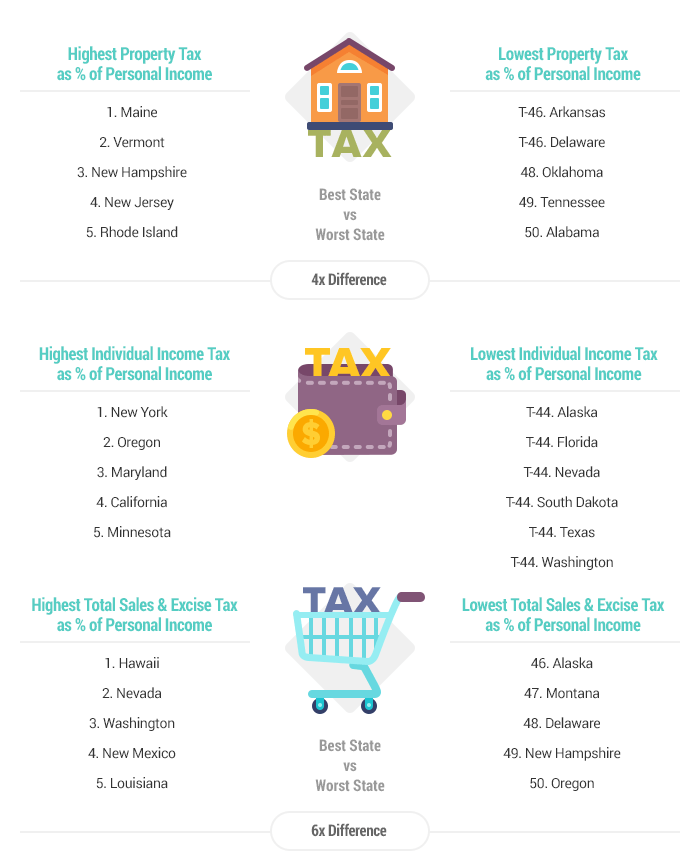

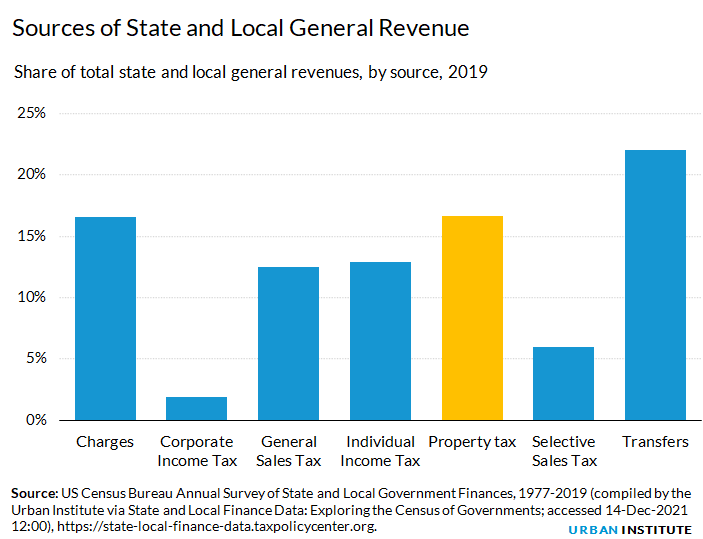

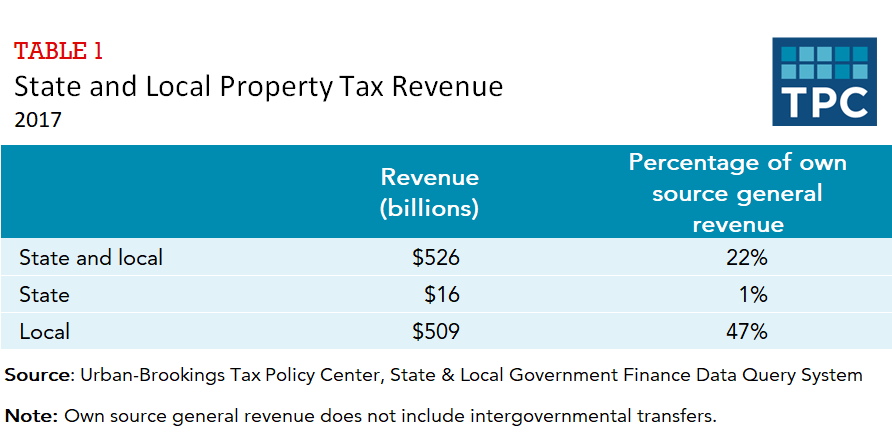

Property Taxes Urban Institute

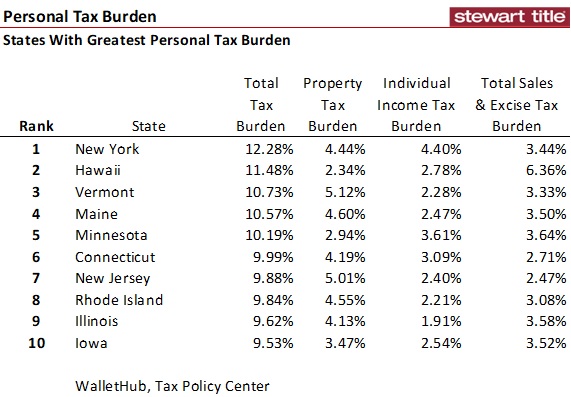

Up to 25 cash back Massachusetts taxpayers pay 105.

. Your average tax rate is 1198 and your marginal tax rate is 22. Assumes Median US. Maine Tax Rates Compared To Other States.

No state sales tax. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent. Vehicle Property Tax Rank Effective Income Tax Rate.

The Town of Scarboroughs new tax rate is now set at 1502 per 1000 of property value for the 2022 fiscal year which runs from July. Other New England states ranked higher than Massachusetts as well including Vermont at 1075. Pulling up stakes and moving from one state to.

Maine Tax Rates Compared To Other States. This tool compares the tax brackets for single individuals in each state. Connecticut at 1044 and Rhode Island at 969.

This marginal tax rate means. All these rates apply to incomes over 2 million with the highest rate of 1090. How does Maines tax code compare.

Those are all good reasons to choose Maine as a retirement destination but what about the states tax system. Compared with other states Maine has relatively punitive tax rules for. State tax rates and rules for income sales gas property cigarette and other taxes that impact middle-class families.

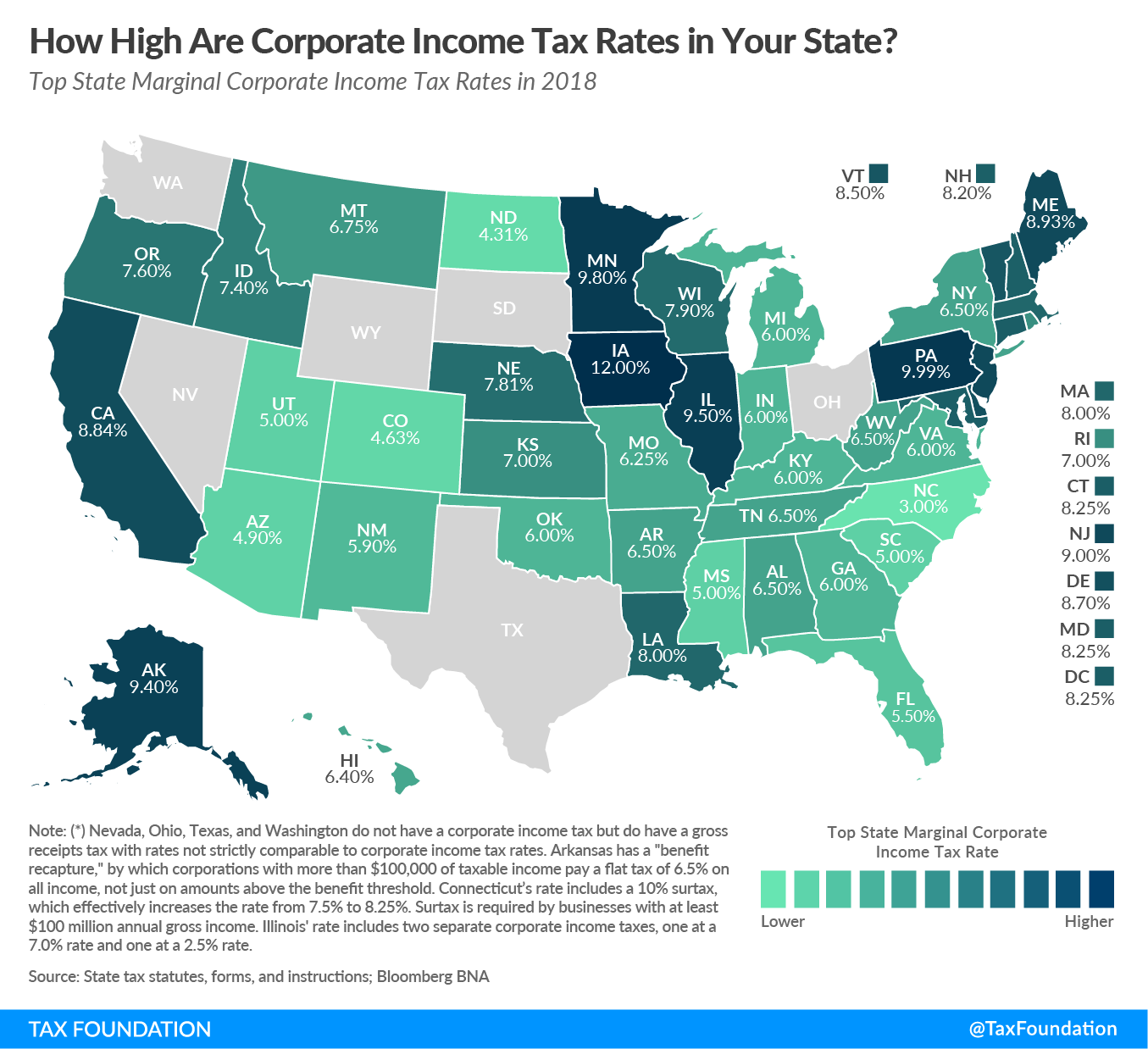

Maine also has a corporate income tax that ranges. The previous 882 rate was increased to three graduated rates of 965 103 and 109. But the above chart provides a rather crude measurement of comparative state and local tax burdens because everybody is.

One tax collection area where New Hampshire. The analysis released Wednesday by financial website WalletHub compared each state on the basis of three types of taxes individual income tax property tax and. Use this tool to compare the state income taxes in Maine and Massachusetts or any other pair of states.

Household has an income equal to 63218 mean third quintile US.

17 States With Estate Taxes Or Inheritance Taxes

Colorado Sales Tax Rate Rates Calculator Avalara

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

What Maine Town Has The Lowest Mill Rate Maine Homes By Down East

![]()

Report Millionaires Didn T Flee When Tax Rates Increased In Certain States Maine Beacon

These States Have The Highest And Lowest Tax Burdens

State Corporate Income Tax Rates And Brackets Tax Foundation

If Doctors Chose Their Job Locations Based On State Income Taxes White Coat Investor

Chart Current California Income Tax Brackets Rates And The Proposition 30 And Proposition 38 Tax Hikes Compared To The Maximum Income Tax Rate In 49 Other States San Diego Reader

Hawaii Has The Lowest Property Tax Rate In The U S Locations

How Do State And Local Property Taxes Work Tax Policy Center

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

Does Maine Have A Income Tax Clj

States With The Highest And Lowest Taxes

Study Shows Maine State And Local Effective Business Tax Rate Among Highest In Nation The Maine Wire

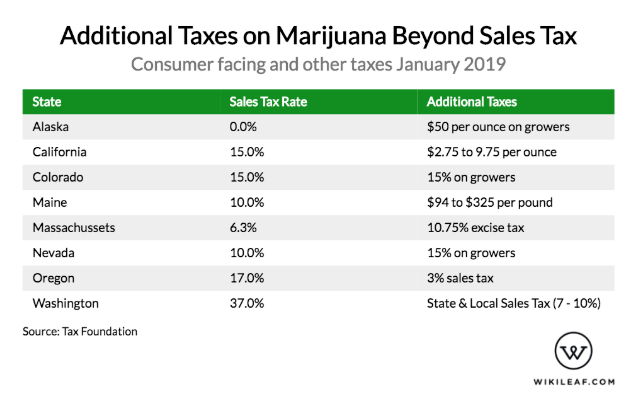

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation